PracticeENDURE: Stand Alone Tail Coverage

Stand-Alone Extended Reporting Period Policy

If your insurance needs are in transition due to a change in employment or practice circumstances and you need to purchase an Extended Reporting Period (Tail), then look no further. We offer competitive Stand-Alone Extended Reporting Period policies through our PracticeENDURE policy for physicians and surgeons across the country. As a pioneer in the industry, Aspen Insurance Holdings, LTD was actually one of the first insurance companies to offer this type of policy and we’ve been committed to it ever since.

What is an Extended Reporting Policy Period?

Stand-Alone Extended Reporting Period policies are designed to cover claims reported after the termination of a practitioner’s expiring claims made policy. It’s important to note that Stand-Alone Extended Reporting Period policies do not cover claims resulting from professional services rendered after the termination of the prior policy. Rather, they extend the ability to report a claim arising out of professional services rendered prior to the termination of the expired claims made policy.

Historically, Extended Reporting Periods (ERPs or Tail) were only available through a practitioner’s incumbent insurance carrier; however, we are pleased to work with our insurance carriers to offer Stand-Alone Extended Reporting Period policies to physicians and surgeons.

The PracticeENDURE Advantage

Purchasing an Extended Reporting Period policy is a serious commitment. You are relying on your carrier to be there for you for years to come. Backed by the financial stability of an “A” Excellent A.M. Best XV rated insurance company, our PracticeENDURE Extended Reporting Period policy has the endurance to stay with you for when the time comes that you will need us most.

Our PracticeENDURE Extended Reporting Period policies are customizable and feature:

Unlimited reporting periods or shorter duration available as requested

Modified or full consent to settle provisions based on availability

Defense costs in addition to medical professional limits of liability

Coverage for corporations and physician extenders on a shared or separate limits basis upon request

Administrative Proceedings Defense Reimbursement up to $25K per claim / $25K policy aggregate per physician insured*

Payments plans for premiums in excess of $50K

* This is an optional endorsement that provides reimbursement of defense expenses associated with investigations of a state medical board related to a claim arising out of professional services that is otherwise covered under the policy

All coverage is underwritten through Aspen Insurance Holdings, LTD. Aspen writes specialty insurance in the United States on a surplus lines basis through Aspen Specialty Insurance Company. Aspen’s operating subsidiaries have been rated “A” Excellent by A.M. Best for financial stability.

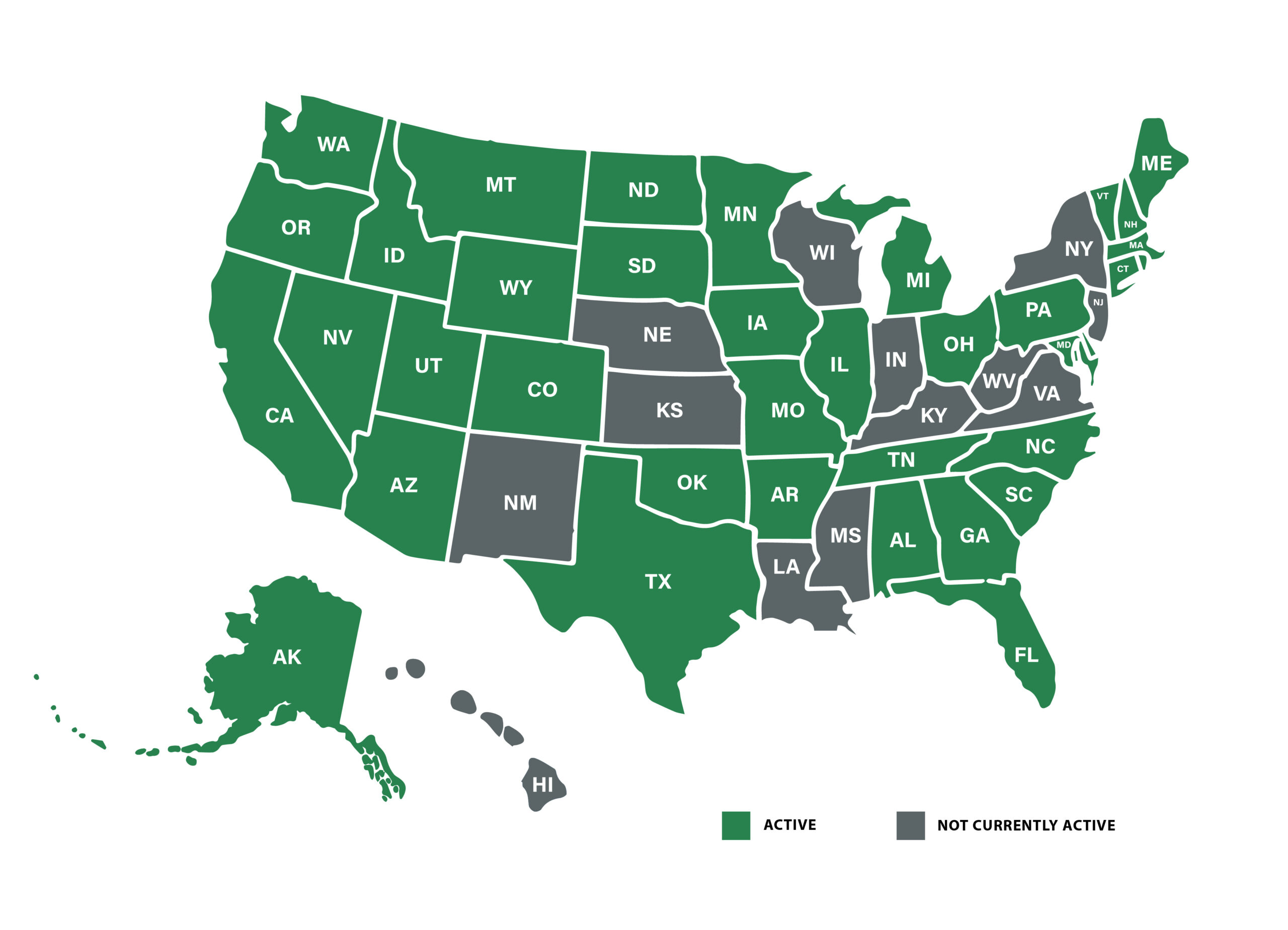

Stand-Alone Tail Coverage Nationwide Availability

How To Report A Claim

Prompt reporting of claims and potential claims (incidents, circumstances and/or records requests that could reasonably give rise to a claim) is a critical first step in the defense of a claim. Even if a formal allegation has not yet been made, reporting adverse patient outcomes puts us on notice that a claim may develop in the future. It is always best to err on the side of caution when determining if an incident should be reported. The sooner we know about a matter then the sooner we can devote our resources to mitigate any future claims that may arise.

Send claims notice to: [email protected]